Wetter- und Klimarisiko

Wetter- und Klimarisiken können regional sehr unterschiedlich sein. Detailanalysen unter Verwendung von hochaufgelösten Wetter- und Klimadaten und unter Einbeziehung unternehmensspezifischer Informationen erlauben eine Quantifizierung Ihres individuellen Wetter- und Klimarisikos.

Zur Darstellung des Wetter- und Klimarisikos werden verschiedenste finanzwirtschaftliche Kennzahlen, wie etwa der Value at Risk (VaR), herangezogen. Beim VaR handelt es sich um ein Risikomaß, aus dem sich für die betrachtete Kennzahl der Maximalverlust ableiten lässt, der innerhalb eines festen Zeitraums (z.B. ein Jahr) mit einer bestimmten Wahrscheinlichkeit möglich ist.

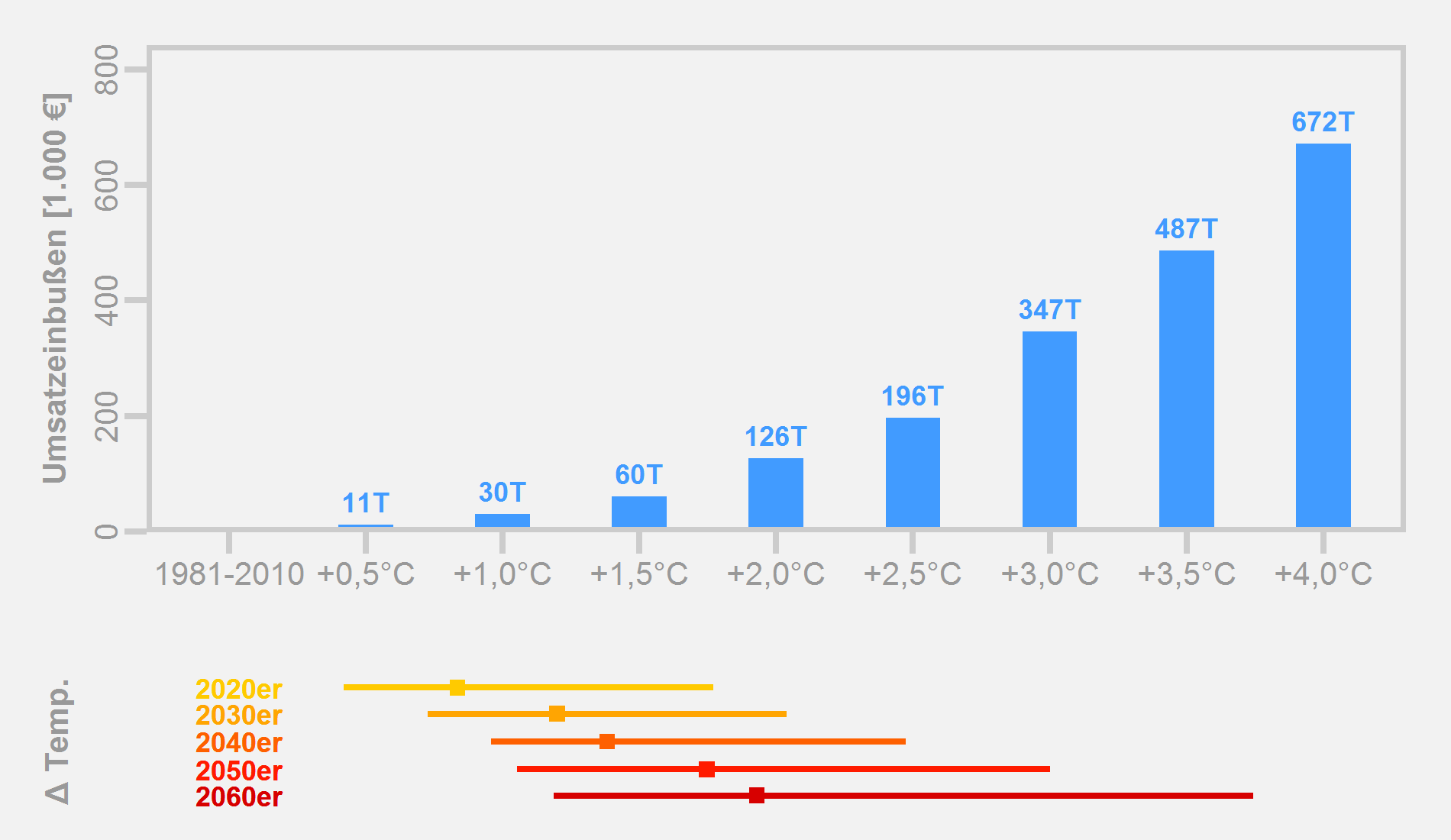

Für die strategische Planung Ihres Unternehmens ist es empfehlenswert, die zu erwartenden klimabedingten Änderungen in der Nachfrage bzw. in den Erzeugungsmöglichkeiten Ihrer Produkte und Dienstleistungen zu berücksichtigen. Dies trifft insbesondere auch auf langfristige Investitionsentscheidungen zu. Eine frühzeitige Anpassung an den Klimawandel bringt Ihnen deutliche Wettbewerbsvorteile.

WEDDA-4CPI (WEDDA® for climate proof investment) bewertet Ihre Investitionsoptionen unter Berücksichtigung der damit verbundenen Klimachancen und -risiken. Regionale Klimaszenarien und/oder Schneesimulationen werden herangezogen, um die Auswirkungen auf die Nachfrage nach Ihren Produkten und Dienstleistungen abzuschätzen. Diese finden in der Wirtschaftlichkeitsberechnung der betrachteten Investitionsoption Berücksichtigung.